Venture capital flows and which sectors attract new funding cycles

In recent years, venture capital has played a pivotal role in shaping innovation and economic growth worldwide. As startups evolve and new technologies emerge, tracking where venture capital flows reveals prevailing market trends and investor priorities. This article examines recent patterns in venture capital investment and highlights the sectors currently attracting fresh funding cycles.

Current Trends in Venture Capital Investment

Venture capital investment has demonstrated resilience despite fluctuating economic conditions and global uncertainties. Industry reports indicate a steady increase in deal volume and capital deployed, signaling sustained investor confidence. Notably, there is increased interest in early and growth-stage companies that show potential for disruption and scalability. Geographic diversification of venture capital flows is also emerging as investors extend their reach beyond traditional technology hubs.

Technology and Software Continues to Dominate

The technology sector remains the dominant recipient of venture capital funds globally. Within this broad category, software-as-a-service (SaaS) companies, cybersecurity firms, and artificial intelligence startups attract substantial investments. This prevalence owes largely to the ongoing digital transformation across industries, fueling demand for innovative solutions that enhance operational efficiency, data security, and automation capabilities.

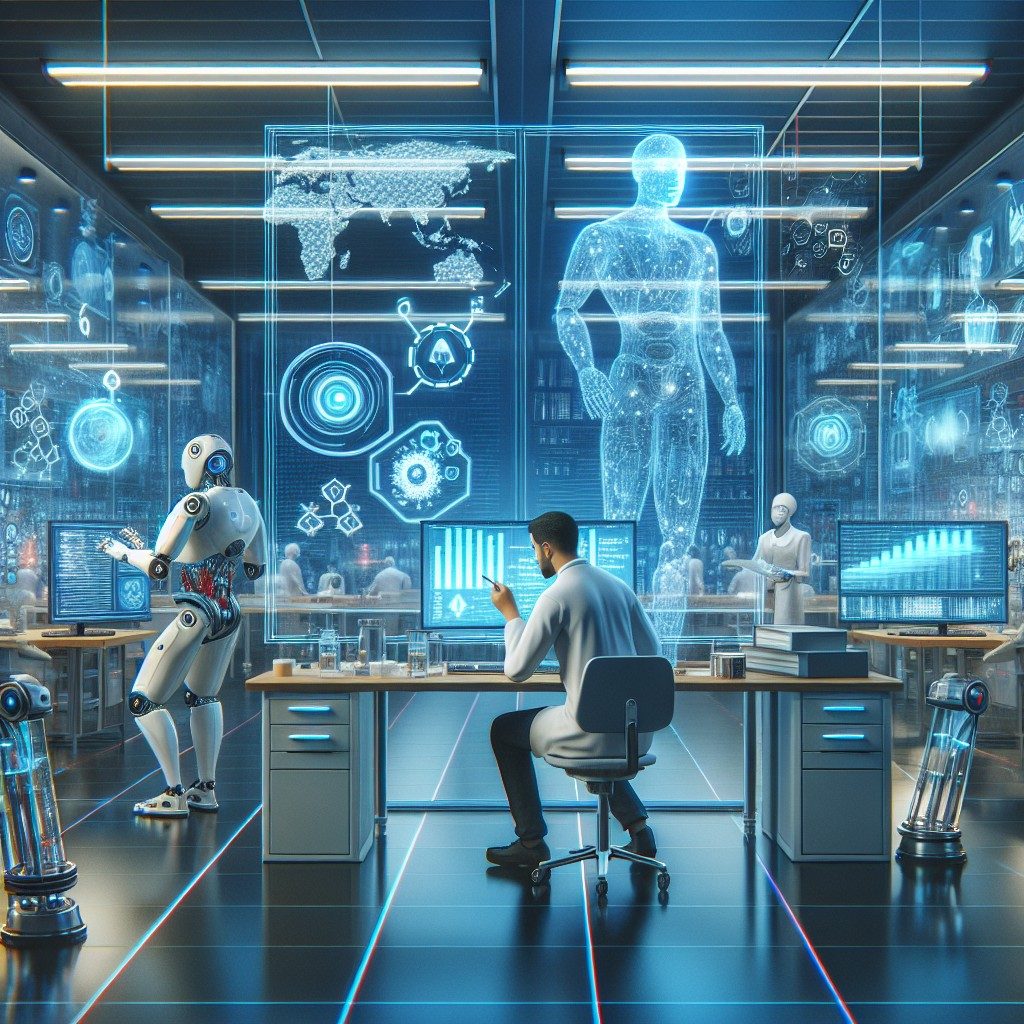

Healthcare and Biotechnology Attracting Growing Interest

Healthcare and biotechnology sectors have experienced notable increases in venture capital inflows. The COVID-19 pandemic underscored the importance of rapid medical innovation, prompting heightened investor focus on companies involved in drug development, diagnostics, and digital health platforms. Emerging fields such as gene editing and personalized medicine have also seen accelerated funding, reflecting optimism about long-term growth potential.

Climate Tech and Sustainable Investments Gain Momentum

As climate awareness intensifies, venture capital funding directed towards climate tech and sustainability-oriented startups has surged. This includes ventures focused on renewable energy technologies, carbon capture, sustainable agriculture, and electric mobility solutions. The global push for carbon neutrality and regulatory incentives have created fertile ground for investors seeking to balance financial returns with environmental impact.

Financial Technology (FinTech) Expands Its Footprint

FinTech continues to attract large venture capital rounds as companies innovate in payments, lending, wealth management, and blockchain technologies. Digital banking solutions and decentralized finance (DeFi) platforms are particularly popular among investors. The sector’s ability to disrupt traditional financial services and enhance accessibility has made it a persistent focal point for venture capital funding.

Conclusion: Outlook for Venture Capital Flows

The flow of venture capital remains robust, with clear preferences for sectors demonstrating technological innovation and societal impact. While technology and healthcare sectors retain strong positions, emerging areas like climate tech and FinTech exhibit rapid growth and investor enthusiasm. Given current trajectories, venture capital is expected to continue driving transformative developments across diverse industries, supported by evolving investor strategies and market demands. For stakeholders, understanding these patterns is crucial for aligning investment and innovation objectives.

Frequently Asked Questions about venture capital

What is venture capital and why is it important?

Venture capital is a form of private equity financing provided to early-stage and growth companies with high growth potential. It is important because it enables startups to access necessary funds for development, innovation, and market expansion, often fueling economic growth and technological progress.

Which sectors currently attract the most venture capital funding?

Sectors such as technology, healthcare, biotechnology, climate tech, and financial technology (FinTech) are currently attracting the most venture capital funding due to their growth prospects and potential for innovation.

How do venture capital flows influence startup ecosystems?

Venture capital flows provide critical resources and mentorship that help startups scale operations, develop products, and access markets. These investments often create vibrant startup ecosystems by promoting entrepreneurship and attracting talent and further capital.

Are venture capital investments geographically concentrated?

While venture capital historically concentrated in established markets like Silicon Valley, there is increasing geographic diversification as investors seek opportunities in emerging markets and global innovation hubs, expanding the reach of venture capital.

What factors drive changes in venture capital funding trends?

Changes in venture capital funding trends are driven by technological advancements, regulatory environments, market needs, and global economic conditions, influencing investor preferences toward certain sectors or stages of company development.

For more detailed insights and updates on venture capital activities, the venture capital section of major financial news outlets provides reliable, up-to-date information.